How much will working with Kennedy Accountancy cost?

The short answer is, it depends. The end.

Joking. Thankfully we are a little more structured in our pricing methods than that. It’s not possible to give a fixed answer on here, and that is because every business is so different. If you needed some plumbing work done in your house you would expect to get a specific quote based on those needs. We work in the same way. However, what we can do here is explain how our fees are calculated.

Our pricing methodology

We use a structured pricing methodology for all clients and all prospective clients. This means that our pricing is fair, transparent and consistent. We don’t price using an hourly rate method, because where is the incentive for us to be as efficient as possible if using an hourly rate? You shouldn’t care how long it takes us, you should care about the quality of work you receive from us..

Here are the different things that we take into consideration when pricing work. All of these things together will affect the fees you pay to us to be your accountants.

- Your turnover (level of sales)

The higher your annual turnover, the higher the fees you will pay to us. It makes sense that a business making £1 million of sales a year will pay more for their accountancy services than a business making £30k a year. The £1 million a year business is more complex, which we touch on later.

- Number of transactions

If we are providing bookkeeping services then the price will depend on the number of transactions your business has per month. This applies to things like how many purchase invoices we have to process and how many bank transactions there are. The higher the number of transactions, the higher the price.

This is why businesses like hotels/restaurants and shops tend to pay much higher bookkeeping fees than say a consultancy business, because there is such a high volume of purchase invoices.

When your transactions go up, celebrate that. Your business is growing!

- Your industry

Our pricing method has evolved over time. When we started the business we priced all industries equally. However, some industries are simply more complex than others in terms of the work involved in preparing accounts. So they will pay a higher price. For example, a one man band barber working from home is a completely different business to a construction business who is VAT registered, has CIS subbies and tends to have a van full of fuel receipts. The more complex the business, the higher the fee.

- Who is doing what

Clients who do their own bookkeeping pay more for their year end accounts and tax return than clients who let us do the bookkeeping. We are trained to do bookkeeping; you are not.

No matter how good a client is (or thinks they are) at bookkeeping, it still takes more work for us to do the year end stuff than if we did it all in house. Therefore, we charge more for the extra work involved. It’s your choice to do your own bookkeeping and you pay more for making that choice. As an aside, if you do choose to do your own bookkeeping then we will train you on the method we need you to follow. Which, if you are used to doing it yourself already, might look very different to your current process!

- What we need to do for you

This sounds obvious but if we have more to do for a business then the fee goes up, and if we have less to do then the fee goes down. For example, if you become VAT registered then we add on a fee for doing your VAT returns. If you then deregister and VAT returns are no longer needed then your monthly fee is adjusted to take those off. You may not be aware but many accountants charge just a flat lump sum, no matter what work is needing done.

Other considerations

Fee reviews

If you are a bookkeeping client then your fee will be reviewed quarterly, to check the transaction numbers I mentioned above. If they have gone up, the fee goes up. If they have gone done, the fee goes down.

We also do annual fee reviews to check things like your turnover levels and to check the scope of the work we are doing for you. This is to make sure we aren’t doing anything for you that wasn’t originally quoted for.

Monthly fees

If you have an existing accountant you might be getting a lump sum bill at year end. This likely isn’t broken down into what it is for. We work in a different way. We work on monthly fees, agreed via a fee proposal at the beginning of us working together (more on that below). Monthly fees are better for everyone’s cashflow and it means your business can plan for its accountancy bills, rather than having an unknown lump sum now and again.

The only fees which are billed as ‘one off’ rather than monthly would be things like software training sessions, catch up work from prior years and HMRC registration costs.

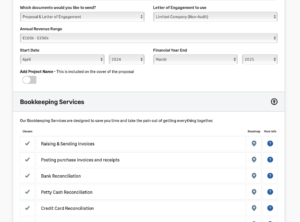

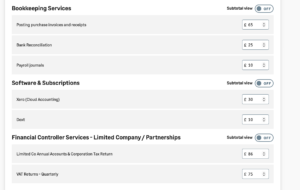

The fee proposal

You will have seen the term ‘fee proposal’ mentioned above. This is the document we send over to a prospective client when they ask us to quote for their business. We use a software called GoProposal which has all our services built into it. We input the information for your business, and it gives the costs. It’s all built around the methodology above and it ensures that our pricing is transparent (each thing you need is broken down to make up the monthly fee) and consistent.

We send over the proposal to you along with a short video explaining how it works. Clients love these videos and we get a lot of feedback on how helpful they are.

If you click on this video link you can see me walking through an example fee proposal. Below are a couple of screenshots from the fee proposal system as well, but we recommend watching the video which gives a better idea of it.

And lastly…

We are not the cheapest. We don’t offer a cheap service. We offer a quality service, where we care about our clients and doing the best for them. That comes at a price. We also aren’t the most expensive either. What we are is fair, and our pricing method means you will be paying a fair price for your business’ accountancy fees.

If you would like to work with us and get a quote for what your business needs then fill in the contact form here and we will be in touch.